Board Paper of Class 12 2022 Accountancy Term 1 Set 4 Solutions

General Instructions:

- This question paper contains 60 questions out of which 40 questions are to be attempted. All questions carry equals marks.

- This question paper consists of three Parts I, II, and III.

- Part I is compulsory for all candidates. Attempt either Part II or Part III.

- Part I comprises of three sections – Section A, B and C.

- From Part I (Q.No. 1 to 36) – attempt any 14 questions each from Section A and B. Attempt any three questions from Section C.

- From Part II OR III (Q.No. 37 to 60) – attempt any four questions from Section A and any five questions from Section B.

- Attempted first, desired number of questions only, in each Part/Section will be evaluated.

- There is only one correct option for every multiple choice question (MCQ). Marks will not be awarded for answering more than one option.

- There is no negative marking.

(Instructions : Attempt any 14 questions from question number 1 to 16.)

Question 1

The document that contains the terms of partnership is called:

- Partnership Agreement

- Partnership Contract

- Partnership Deed

- Partnership Rules

Sol. (c);

Question 2

A, B, C and D are partners in a firm. They want to expand their business for which additional capital and more managerial experts are required. For this they want to admit more members in their firm. What is the maximum number of additional members that can be admitted by them in the firm:

- 02

- 50

- 20

- 46

Sol. (d)

Question 3

Vijay and Rattan are partners in a firm. The partnership agreement provides for interest on drawings @ 12% per annum. Which of the following accounts will be debited to transfer interest on drawings to Profit and Loss Appropriation Account :

- Interest on Drawings account

- Bank account

- Partners’ Current accounts

- Partners’ Capital accounts

Sol. (a)

Question 4

A and B were partners in a firm. Their capitals at the end of the year ending on 31.3.2022 were ₹3,00,000 and ₹1,50,000 respectively. During the year B withdrew ₹10,000 which was debited to his capital account. Profit for the year ended 31st March, 2022 was ₹32,000 which was credited to their capital accounts. During the year B introduced additional capital ₹32,000. What was B's capital on 1.4.2020?

- ₹1,50,000

- ₹1,60,000

- ₹1,12,000

- ₹1,52,000

Sol.(c)

Question 5

P, Q and R were partners in a firm sharing profits and losses in the ratio 2:2: 1. They admitted L as a new partner for th share in the profits. L was given a guarantee that his share of profit shall be ₹1,00,000. Any deficiency arising on account of guarantee to L will be borne by Q. The profit of the firm during the year ended 31.3.2022 was ₹4,00,000. The amount of deficiency borne by Q was :

- ₹80,000

- ₹20 000

- ₹1,10,000

- ₹6,667

Sol. (b)

Question 6

X and Y were partners in a firm sharing profits and losses equally. Their capitals were ₹2,00,000 and ₹3,00,000 respectively. Z was admitted as a new partner for share in the profits of the firm. Z brought ₹2,00,000 as his capital. The goodwill of the firm was:

- ₹1,00,000

- ₹25 000

- ₹2,00,000

- ₹7,00,000

Sol. (a)

Question 7

R and M were partners in a firm, sharing profits and losses in the ratio of 5:3. L was admitted as a new partner for share in the profits of the firm. The new profit ratio was 2:2: 1. L brought ₹1,54,000 for his capital and did not bring his share of goodwill premium. Goodwill of the firm on L’s admission was estimated at ₹4,50,000. It was decided not to raise goodwill account on L's admission. Out of the following what will be the correct treatment of goodwill on L’s admission?

- Debit L’s current A/c by ₹90,000 and credit R’s and M’s capital A/cs by ₹45,000 each.

- Debit L’s current A/c by ₹90,000, Debit M's capital A/c by ₹11,250, credit R’s capital A/c by ₹1,01,250.

- Debit L's current A/c by ₹90,000 and credit R’s capital A/c by ₹56,250 and credit M’s capital A/c ₹33,750.

- Debit L’s current A/c by ₹4,50,000 and credit R’s and M’s capital A/c by ₹2,25,000 each.

Sol (b);

Question 8

Sharma and Verma were partners in a firm. The partnership deed provided that interest on partners' drawings will be charged @ 12% per annum. During the year Sharma withdrew ₹6,000. Interest on his drawings will be

- ₹600

- ₹330

- ₹360

- ₹720

Sol. (c);

Question 9

When a combined ‘Share Application and Allotment Account’ is opened in the books of the company, which of the following accounts will be debited for money refunded on rejected application:

- Share Application Account

- Share Application and Allotment Account

- Share Allotment Account

- Bank Account

Sol. (b);

Question 10

Shubham Ltd. purchased a machinery of ₹3,80,000 from Ganpati Ltd. The payment was made by issue of ₹3,000 equit shares of ₹100 each at a premium of 10% and the balance by issuing a cheque. The amount of cheque issued in favour of Ganpati Ltd. was:

- ₹80,000

- ₹3,80,000

- ₹30,000

- ₹50,000

Sol. (d);

Question 11

Pooja Ltd. issued 50,00,000 equity share of ₹100 each at a premium of ₹30 per share. Half of the premium amount was payable on allotment and the remaining half was payable on first call. Raja to whom 500 shares were allotted failed to pay the first call and second and fihal call. His shares were forfeited. On forfeiture of shares the amount debited to ‘securities premium reserve account’ was:

- ₹7,500

- ₹15,000

- Nil

- ₹50,000

Sol. (a);

Question 12

Y Ltd. invited applications for issuing 1,00,000 equity shares of ₹10 each at a premium of ₹8 per share. The amount per share was payable as follows :

On Application – ₹8 per share (including ₹5 premium)

On Allotment – ₹8 per share (including ₹3 premium)

On first and final call – Balance

Applications for 1,50,000 shares were received. Mohan who hdd applied for 4,000 shares paid the entire share money, on shares applied, with application. The application money received was :

- ₹12,00,000

- ₹8,00,000

- ₹12,40,000

- ₹10,00,000

Sol.(c);

Question 13

Which of the following accounts will be debited for transferring loss on revaluation of assets and reassessment of liabilities at the time of admission of a new partner mto the partnership firm :

- Old partner’s capital accounts in old profit sharing ratio

- Old partners capital accounts in sacrificing ratio

- All partners capital accounts (inclupding incoming partner) in new profit sharing ratio

- Revaluation account

Sol.(a);

Question 14

A business earned average profits of ₹60,000 during the last three years. The nonnal rate of return on similar business is 12%. The value of net assets of the business is ₹4,00,000. Its goodwill by capitalisation of Average Profits Method will be :

- ₹1,00,000

- ₹2,00,000

- ₹4,00,000

- ₹50,000

Sol. (a);

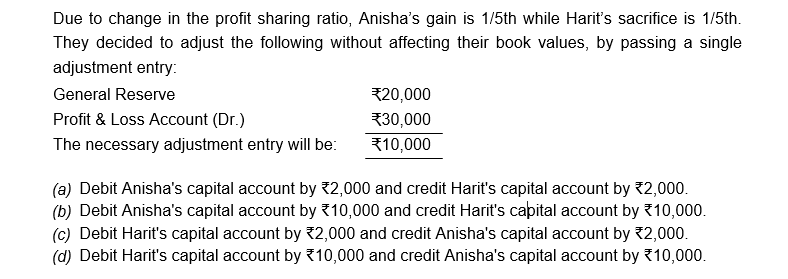

Question 15

Sol. (c);

Question 16

Leela and Meeta were partners in a firm sharing profits and losses in the ratio of 7:3. Geeta was admitted as a new partner for a share in the profits of the firm. The new profit sharing ratio will be :

- 7 : 3 : 7

- 7 : 3 : 3

- 3 : 7 : 7

- 1 : 1 : 1

Sol. (b);

(Instructions : Attempt any 14 questions from question number 17 to 32.).

Question 17

Given below are two statements one labelled as Assertion (A) and the other labelled as Reason (R) :

Assertion (A): Co-ownership ofproperty amounts to partnership.

Reason (R): The element ofbusiness is present in co-ownership.

In the context of the above two statements which ofthe following is correct.

- Both (A) and (R) are correct and (R) is correct reason for (A).

- Both (A) and (R) are incorrect.

- (A) is correct but (R) is incorrect.

- (D) Both (A) and (R) are correct but (R) is not the correct reason for (A).

Sol. (b);

Question 18

Z Ltd. forfeited 800 shares of ₹10 each on which ₹8 per share was called and ₹6 per share was paid. The amount with which share capital account debited on the forfeiture of these shares was:

- ₹8,000

- ₹6,400

- ₹4,800

- ₹3,200

Sol. (b);

Question 19

A situation where number of shares offered to the public for subscription are less than the number of shares for which applications have beeen received is called :

- Under subscription

- Fully subscribed

- Over subscription

- Both (b) and (c)

Sol. (c);

Question 20

Which of the following statements are correct :

- The liability of a partner for acts of the firm is unlimited

- Private assets of a partner can also be used for paying the debts of the firm.

- Each partner is liable jointly with all other partners and also severally to the third parties for all the acts of the firm done, while he is a partner.

- The liability of a partner is limited to the extent of his capital contribution.

- Only (iii)

- (i) and (ii)

- (i), (ii) and (iii)

- (i), (ii), (iii) and (iv)

Sol. (c);

Question 21

Which of the following statement is not true for fixed capital account ?

- The capital account balance remains unchanged unless there is addition to or withdrawal of capital.

- The capital accounts always show a credit balance.

- Each partner has only one account, i.e. capital account, under this method.

- All adjustments for drawings, salary, interest on capital etc. are made in the current accounts.

Sol: (c);

Question 22

Amar and Samar were partners in a firm sharing profits and losses in the ratio of 1:5. On 1.4.2022 Ganesh was admitted for share in the profits. On the date of Ganesh’s admission the balance sheet of Amar and Samar showed a debit balance of ₹60,000 in the profit and loss account. The accounting treatment for the same in the books of accounts of the firm on Ganesh’s admission will be:

- Amar’s and Samar’s Capital Accounts will be debited by ₹10,000 and ₹50,000 respectively and Profit and Loss Account will be credited by ₹60,000.

- Profit and Loss Account will be debited by ₹60,000 and Amar's and Samar's Capital Accounts will be credited by ₹10,000 and ₹50,000 respectively

- Revaluation Account will be debited by ₹60,000 and Profit and Loss Account will be credited by ₹60,000.

- Profit and Loss Appropriation Account will be debited by ₹60,000 and Profit and Loss Account will be credited by ₹60,000.

Sol. (a);

Question 23

On the reconstitution of a firm, the value of land was to be appreciated by ₹2,00,000 and plant and machinery was to be reduced to ₹7,00,000 from ₹10,00,000. Gain or Loss on revaluation will be :

- Gain ₹1,00,000

- Loss ₹1,00,000

- Loss ₹5,00,000

- Gain ₹5,00,000

Sol: (b);

Question 24

Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R)

Assertion (A) : Goodwill is an intangible asset.

Reason (R) : It is the value of the reputation of a firm in respect of the profits expected in future over and above the normal profits. In the context of the above statements which of the following is correct?

- (Both (A) and (R) are correct.

- (A) is wrong but (R) is correct.

- (A) is correct but (R) is wrong.

- Both (A) and (R) are wrong.

Sol: (a);

Question 25

When a new Partner is admitted, the balance of ‘General Reserve’ appearing in the Balance Sheet is credited to :

- Profit and Loss Appropriation Account

- Capital Accounts of all partners

- Revaluation Account

- Capital Accounts of old partners

Sol. (d);

Question 26

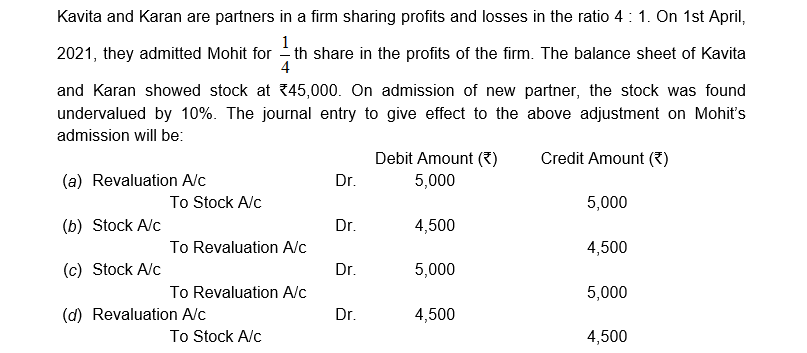

Sol. (c);

Question 27

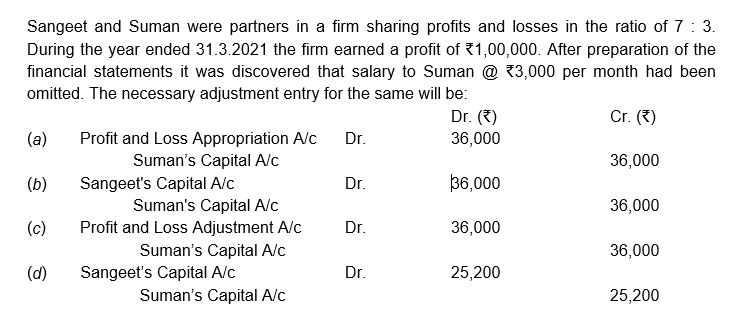

Sol.(d);

Question 28

Roopa and Daya were partners in a firm. They admitted Navin as a new partner for share in the profits. On Navin’s admission it was found that there was a claim against the firm for damages for which a liability for damages should be created. Which of the following accounts will be debited for creating the liability:

- Profit and Loss Appropriation Account

- Profit and Loss Account

- Revaluation Account

- Profit and Loss Adjustment Account

Sol. (c);

Question 29

Given below are two statements, one labelled as Assertion (A) and the other as Reason (R).

Given below are two statements, one labelled as Assertion (A) and the other as Reason (R).

Reason (R) : When the company fails to receive minimum subscription it has to return the application money within 120 days from the date of issue of prospectus.

In the context ofthe apove two statements which of the following is correct:

- Both (A) and (R) are correct.

- (A) is correct but (R) is incorrect.

- Both (A) and (R) are incorrect.

- (A) is incorrect but (R) is correct.

Sol. (b);

Question 30

X Ltd. invited applications for issuing 10,00,000 equity shares of ₹10 each at a premium of ₹9 per share. The amount was payable as follows:

On Application – ₹6 per share (including premium ₹3)

On Application – ₹6 per share (including premium ₹3)

On Allotment – ₹8 per share (including premium (₹4)

On first and final call – Balance

Applications for 15,00,000 shares were received. Shares were allotted on pro-rata basis to all applicants. Excess application money received with applications was adjusted towards sums due on allotment. Dharam to whom 600 shares were allotted failed to pay the allotment money. Allotment amount that was not paid by Dharam was:

- ₹4,800

- ₹600

- ₹3,000

- ₹2,400

Sol: (c);

Question 31

PP Ltd. invited applications for issuing 10,000 equity shares of ₹10 each. Applications for 9,500 shares were received and allotment was made to all the applicants. Ravi a shareholder holding 200 shares failed to pay allotment money and his shares were forfeited. Mohan to whom 100 shares were allotted failed to pay the first call and his shares were forfeited immediately after the first call was made. Afterwards the second and final call was made. The second and final call will be due on how many shares?

- 9,500

- 9,300

- 9,200

- 10,000

Sol.(c);

Question 32

Raman Ltd. was registered with an authorised capital of ₹5,00,00,000 divided into shares of ₹10 each. The company offered for subscription 4,00,000 shares. Applications were received for 4,50,000 shares. Applications for 50,000 shares were rejected. A shareholder holding 10,000 shares failed to pay the first and final call of ₹2 per share. The subscribed capital ofthe company is:

- ₹5,00,00,000

- ₹40,00,000

- ₹45,00,000

- ₹39,80,000

Sol : (d);

(Instructions : From question numbers 33 to 36, attempt any 3 questions.).

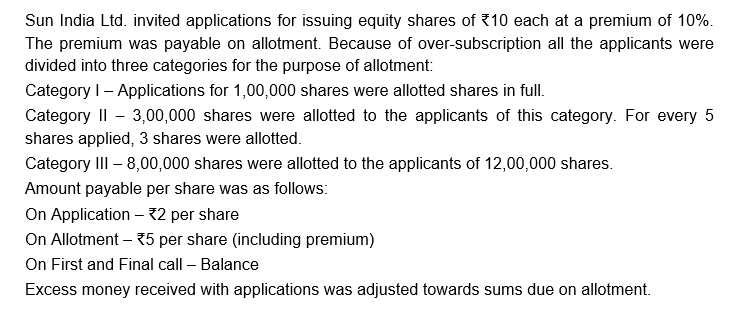

Question 33

How many shares were offered to the public for subscription?

- 12,00,000

- 24,00,000

- 14,00,000

- 30,00,000

Sol. (a)

Question 34

What was the amount of money received on allotment ?

- ₹60,00,000

- ₹12,00,000

- ₹6,00,00,000

- ₹48,00,000

Ans. (d)

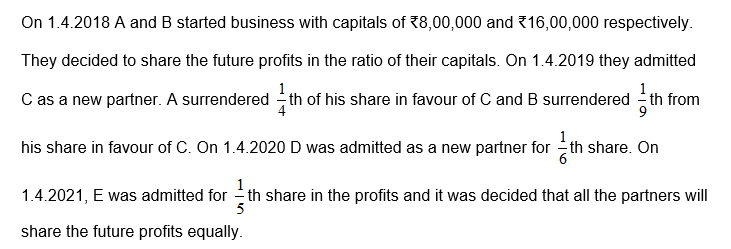

Question 35

The profit sharing ratio of A, B and C was :

- 9 : 20 : 7

- 8 : 21 : 7

- 10 : 19 : 7

- 7 : 22 : 7

Ans. (a);

Question 36

The profit sharing ratio of A, B, C and D was

- 45 : 105 : 30 : 36

- 45 : 100 : 35 : 36

- 45 : 105 : 30 : 36

- 40 : 100 : 40 : 36

Ans. (b);

Part - II

Section - A

(Attempt any 4 questions from question number 37 to 42).

Question 37

The ratios that analyse profits in relation to revenue from operations or funds employed in the business are called

- Profitability Ratios

- Turnover Ratios

- Turnover Ratios

- Liquidity Ratios

Ans. (a);

Question 38

Because of exclusion of non-liquid current assets which of the following ratio is considered better than current ratio as a measure of liquidity position of the business?

- Debt – Equity Ratio

- Acid Test Ratio

- Proprietary Ratio

- Interest Coverage Ratio

Ans. (b);

Question 39

Which of the following ratio establishes relationship of ‘Shareholders funds’ to ‘Net assets’?

- Return on Investment

- Interest Coverage Ratio

- Proprietary Ratio

- Debt–Equity Ratio

Ans. (c) ;

Question 40

Which of the following ratio establishes the relationship between ‘Credit revenue from operations’ and ‘Trade receivables’?

- Inventory Turnover Ratio

- Interest Coverage Ratio

- Trade Payables Turnover Ratio

- Trade Receivables Turnover Ratio

Ans. (d);

Question 41

Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R) :

Assertion (A) : Profitability ratios are calculated to analyse the earning capacity of the business.

Reason (R) : Profitability ratios are calculated to determine the ability of the business to service its debt in the long run.

In the light of the above two statements which of the following is correct:

- Both (A) and (R) are correct

- Both (A) and (R) are wrong.

- (A) is correct but (R) is wrong

- (A) is wrong but (R) is correct.

Ans. (c) ;

Question 42

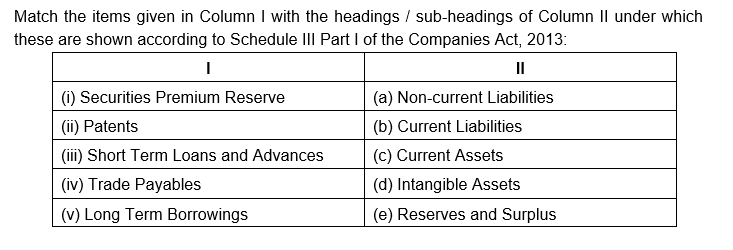

- (i) – (e), (ii) – (d), (iii) – (c), (iv) – (b), (v) – (a)

- (i) – (a), (ii) – (b), (iii) – (c), (iv) – (d), (v) – (e)

- (i) – (b), (ii) – (c), (iii) – (a), (iv) – (d), (v) – (e)

- (i) – (a), (ii) – (b), (iii) – (e), (iv) – (d), (v) – (c).

Ans. (a)

Part - II

Section - B

(Attempt any 5 questions from question number 43 to 48. ).

Question 43

Current ratio of a company is 3 : 1. The value of its current liabilities is ₹4,00,000. Its current assets will be:

- ₹3,00,000

- ₹12,00,000

- ₹2,00,000

- ₹9,00,000

Ans. (b)

Question 44

Gross Profit Ratio or a Company is 25%. Cost of revenue from operations are of revenue from operations. If revenue from operations is ₹6,00,000, the Gross Profit of the Company will be :

- ₹25,00,000

- ₹45,00,000

- ₹15,00,000

- ₹11,25,000

Ans. (c)

Question 45

Following information has been obtained from the statement of Profit and Loss of a Company: Revenue from Operations – ₹20,00,000, cost of materials consumed – ₹8,00,000, Employees benefit expenses – ₹20,000, Finance cost – ₹5,000, Depreciation – ₹25,000. Its Profit before tax will be :

- ₹12,00,000

- ₹11,80,000

- ₹11,75,000

- ₹11,50,000

Ans. (d)

Question 46

Given below are two statements, one labelled as Assertion (A) and the other labelled as Reason (R):

Assertion (A) : 'Sale of goods for cash' does not effect Debt-Equity ratio.

Reason (R) : 'Sale of goods on cash basis' neither affect 'Debt' nor 'Equity'

In the context of the above two statements which of the following is correct:

- Both (A) and (R) are correct and (R) is the correct reason of (A).

- Only (A) is correct

- Only (R) is correct.

- Both (A) and (R) are incorrect.

Ans. (a)

Question 47

Following are two statements, one labelled as Assertion (A) and the other labelled Reason (R):

Assertion (A) : Operating ratio is = 100 – operating profit ratio.

Reason (R) : Operating ratio is computed to reveal the operating margin on products sold.

In the context of the above two statements which of the following is correct:

- Both statements are incorrect.

- (A) is correct but (R) is incorrect.

- (A) is incorrect but (R) is correct.

- Both (A) and (R) are correct and (R) is the correct reason of (A).

Ans. (b)

Question 48

During the year ended 31.3.202 1, Soma Ltd. earned net profit after tax ₹6,00,000. The company has a long term 10% debt of ₹50,00,000. The tax rate is 40%. The interest coverage ratio of the company will be

- 2 times

- 3 times

- 1.2 times

- 1.5 times

Ans. (b)

Part - III

Section - A

(Instruction : From question number 49 to 54 attempt any 4 questions. ).

Question 49

"Hardware, software and data are some of the components of computerised accounting system." Identify the missing component from the statement:

- Procedure and people

- Timely access

- Network

- Raw facts

Ans. (a)

Question 50

Which of the following is not a feature of computerised accounting system:

- Transparency and control

- Data are prone to hacking

- Scalability

- Reliability

Ans. (b)

Question 51

A sequential code is the one which:

- range of numbers is partitioned into desired number of sub-ranges.

- consists of alphabets or abbreviations as symbols to codify a piece of information.

- enables identification of missing documents.

- sub-ranges are allotted to specific groups.

Ans. (c)

Question 52

Method of codification should be:

- An identification mark.

- Easy to understand, cryptic and leads to grouping of accounts.

- Explains a group of information.

- Such that it leads to grouping of accounts.

Ans. (d)

Question 53

Which type of software package is suitable for an organisation where the volume of accounting transactions is very low and adaptability is very high:

- Specific

- Generic

- Tailored

- (a) and (c) both

Ans. (b)

Question 54

Which of the following is not a limitation of computerised accounting system:

- Data may be lost or corrupted due to power interruptions.

- Faster obsolescence forces investment for shorter time.

- Data is not made available to everybody.

- Unprogrammed and un-specified reports cannot be generated.

Ans. (c)

Part - III

Section - B

(Instruction : From question number 55 to 60 attempt any 5 questions).

Question 55

Which of the following is not contained on formula tab on Excel ribbon:

- Page layout

- Function library

- Defined names

- Calculations

Ans. (a)

Question 56

Identify from the following what will be displayed on the screen when numeric value in the formula or function is invalid while working on excel:

- Correct a # REF! Error

- Correct a # NUM! Error

- Correct a # DIV/0! Error

- Correct a # N/A Error

Ans. (b)

Question 57

As you type a number in a cell, what mode appears in the status bar:

- Ready mode

- Edit mode

- Enter mode

- Record mode

Ans. (c)

Question 58

Which of the following is not included in calculation of 'Earning' while preparing payroll for current period?

- Basic pay

- Transport allowance

- Medical allowance

- Provident fund

Ans. (d)

Question 59

What is the outcome of an arithmetic expression or function called?

- Basic Value

- Derived Value

- Vertical Vector

- Horizontal Vector

Ans. (b)

Question 60

How is Navigation conducted from first to last filled cells of clusters when moving one cell at a time in a 'Row'?

- Home + Right arrow ()

- End + Right arrow ()

- CTRL + Right arrow () successively

- CTRL + END

Ans. (c)